Nest stop for evotec moon🚀🌕 r/EuronextBets

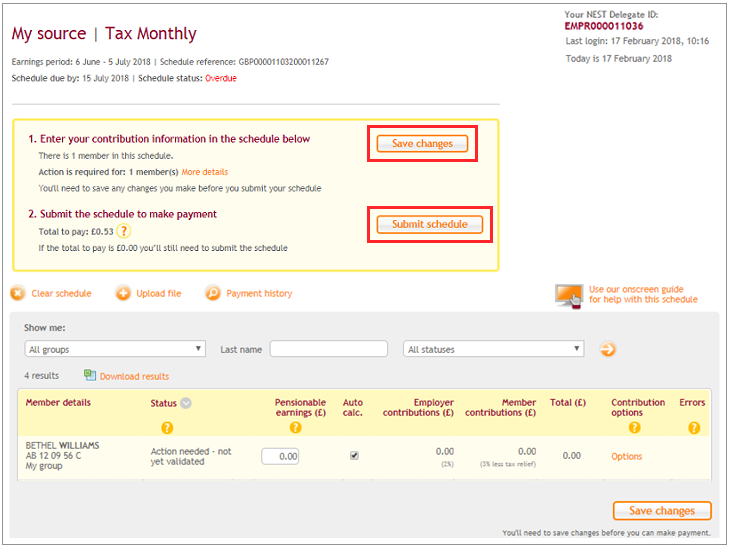

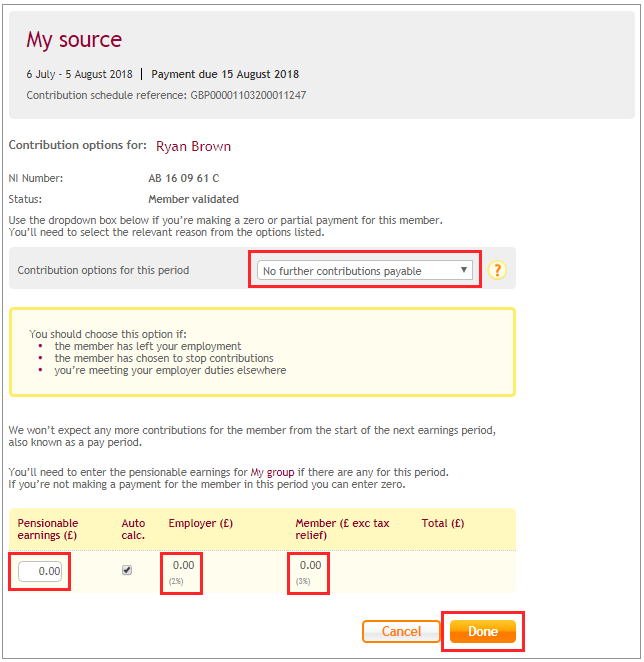

How do I let NEST know if a worker wants to stop making contributions? A worker can decide to stop contributing to their NEST retirement pot for any period of time they choose. They can either do this via their online NEST account, by contacting us or by telling you.

How to pay contributions to NEST NEST Employer Help Centre

The 1.8% fee they take off each contribution eats away at your return and as you've mentioned their investment choices aren't great. So personally I wouldn't pay any more into NEST than you have to to maximise the employer contribution. By the sound of things for you that's £0 and all your contribution is entirely voluntary.

Net's Nest Shelter Knoxville TN

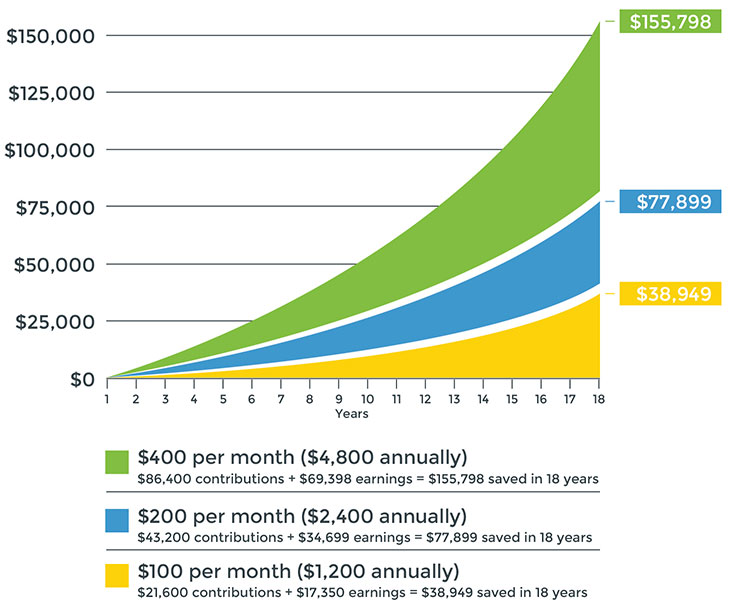

You can set up contributions from your paycheck or directly from your personal bank account. Investing in a college savings plan has many intangible benefits, too. No matter what amount you start with, recurring contributions and earnings compound over time.

Using your account to stop contributions Nest pensions

The main problem with NEST is the contribution charge. So while I understand where you're coming from about not liking them, transferring out doesn't really help that. In fact, once the money is in, the on-going costs are very competitive, so the fund choice is really the only reason to consider a transfer.

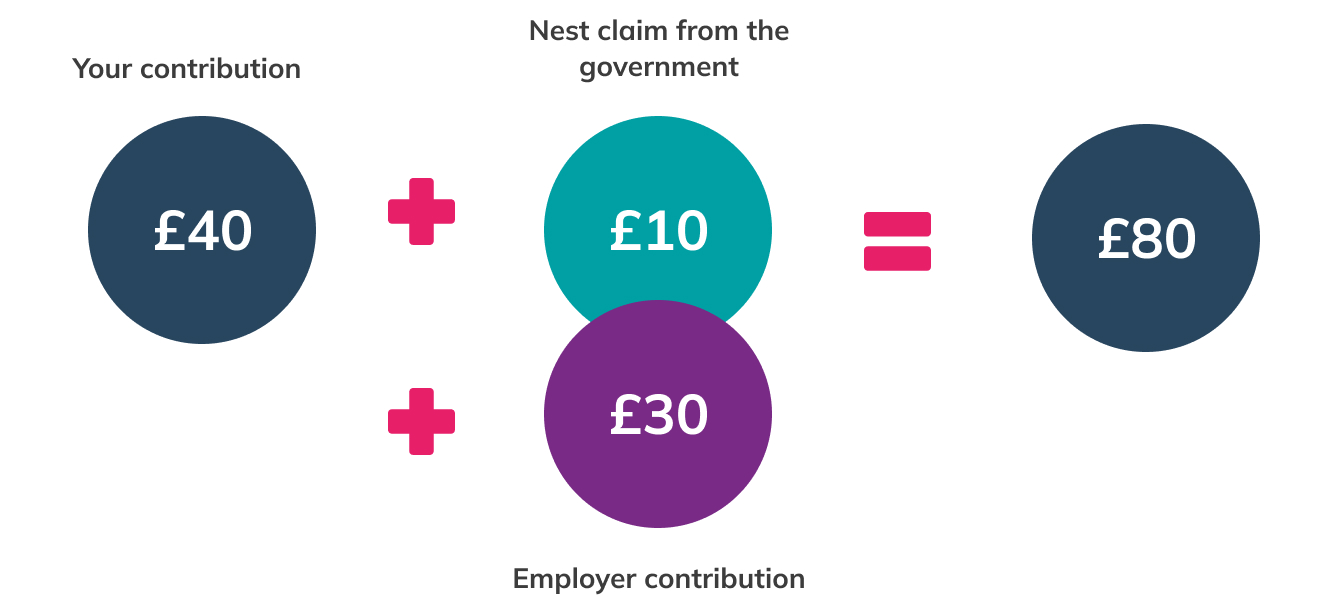

Contributions and fees Nest Pensions

By default, you will contribute 5% of your pay over £6,240 and up to £50,270 (you can find out more about qualifying earnings on the NEST website ). In addition, Compass will contribute 3% so a total of 8% goes into your pension pot. Contributions are deducted from your pay before tax is calculated.

Contributions and Fees Nest Pensions

Nest pensions work like any other workplace pension scheme, with contributions both from you and from your employer, and tax relief on all the contributions you make. If your employer offers Nest you'll be enrolled automatically. You can opt out, but this usually isn't advisable.

MOAA Retirement Contribution Limits Increase In 2019

As the Nest pension scheme is a defined contribution pension scheme, it means that you benefit from your employer contributing to your pension pot. Opting out of Nest would mean that you lose this benefit. How to opt out of a Nest pension

529 Plan Contributions NEST 529 College Savings

Nest energy partners can help you lower bills and earn rewards. Depending on your energy partner, you might be eligible for: A rebate on a Nest thermostat or one at no additional cost: Your energy provider might provide you a Nest thermostat at no additional cost or help you get one for less.This depends on your partner and the programs they offer.

NEST API Contributions YouTube

Originally passed in 1940, this law provides for the protection of the bald eagle and the golden eagle (amended in 1962) by prohibiting the take, possession, sale, purchase, barter, offer to sell, purchase or barter, transport, export, or import, of any bald or golden eagle, alive or dead, including any part, nest, or egg, unless allowed by permit.

Nest contributions

NEST Key Features document (2012) NEST has two types of charge: A contribution charge set at 1.8% of whatever is paid in - so, if you contribute £10, after the charge £9.82 goes into your pot. An annual charge of 0.3% of your pension pot - for example, if your pot is worth £1,000 this year, the annual charge will take away £3, leaving.

Nest n Rest Sheets

Online: Opting out online takes just a few minutes. We'll stop taking further contributions from you immediately, unless your request is after your payroll cut-off date, in which case you'll make one more contribution. Opt out now Phone or post:

Contributions and fees Nest Pensions

Key points: This article offers guidance on contributing to your pension when there's short-term uncertainty in the markets. The article also explains how continuing to contribute could benefit you in the longer term. What impact can global events have on my investments? Are you worried about the impact the Covid-19 pandemic had on your pension?

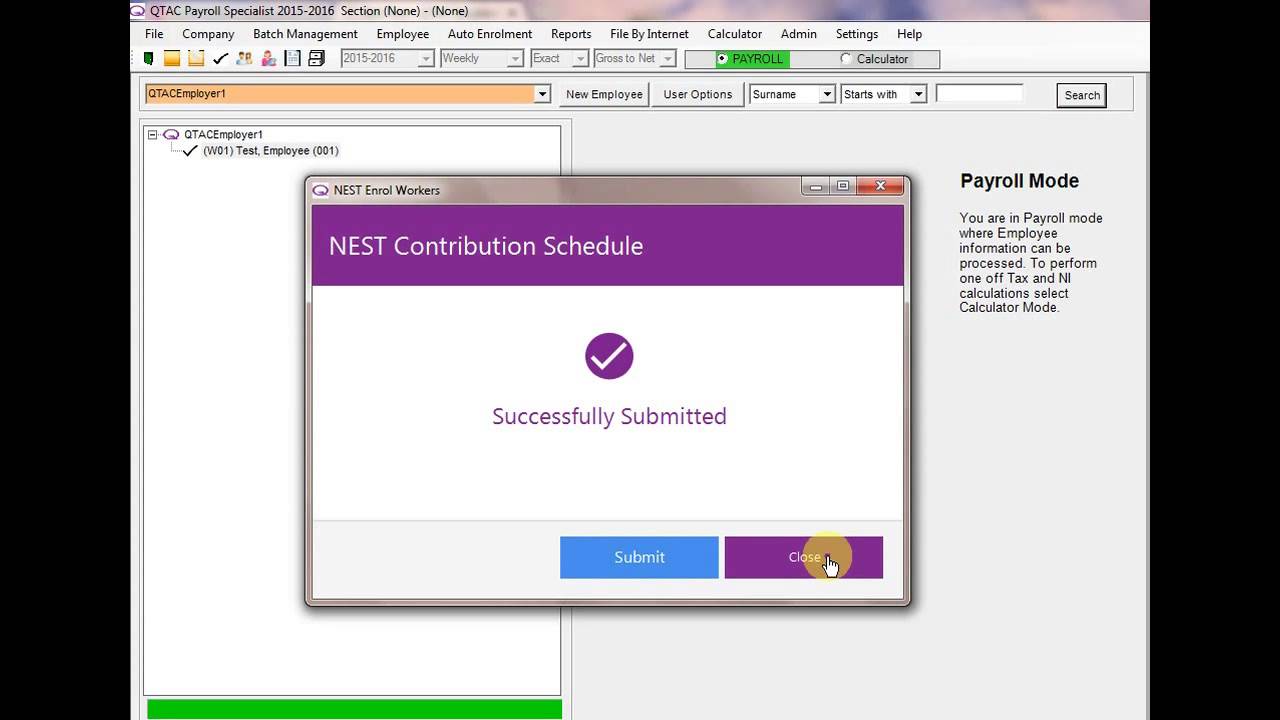

NEST Pensions Creating a New Scheme Qtac Payroll QTAC Solutions Ltd

When you stop contributions, your Nest account remains active unlike opt out wherein your account gets closed. Once you've stopped contributions, any contributions paid will stay in your Nest retirement pot until you take your benefits from age 55 or you transfer it to another pension scheme. How do I stop contributions online?

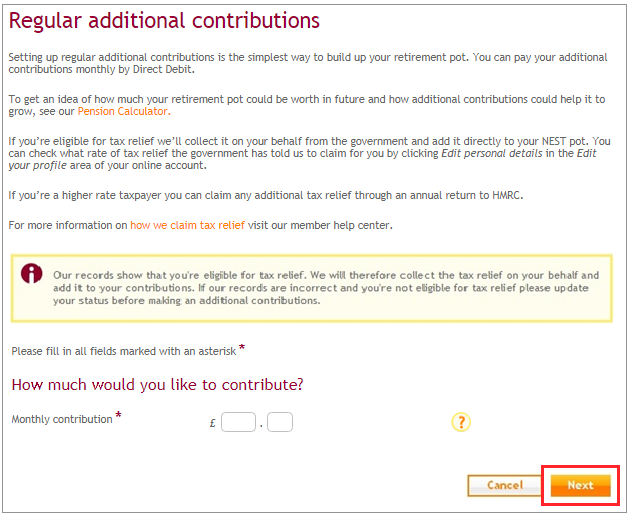

How to make an additional contribution Nest pensions

Stopping contributions Once you're a member of NEST and the opt-out period has ended you might want to stop making contributions or take a break from contributing later on. NEST lets you do this. There's no need to opt out in the first month just because you think you might want to take a contribution break later.

Login Portal Nest Property Management Cedar Rapids

Opting out How do I opt out? When can I opt out? The opt-out period is for one month and it starts three working days from the date you're enrolled. We'll tell you exactly when the opt-out period starts and ends in the letter we send you after you're enrolled. You won't be able to opt out earlier than the start of your opt-out period.

NEST Pensions Submitting Contributions Qtac Payroll QTAC Solutions Ltd

You'll be able to stop your contributions after the opt-out period has passed.. Formerly you opt out, wealth desire end your Nest accounts and any contributions made becoming be refunded to your employer within 10 working total. What do I optional out? Yours need the following options to opt out of Nestling.